Swiss National Bank Exchange Rate Floor

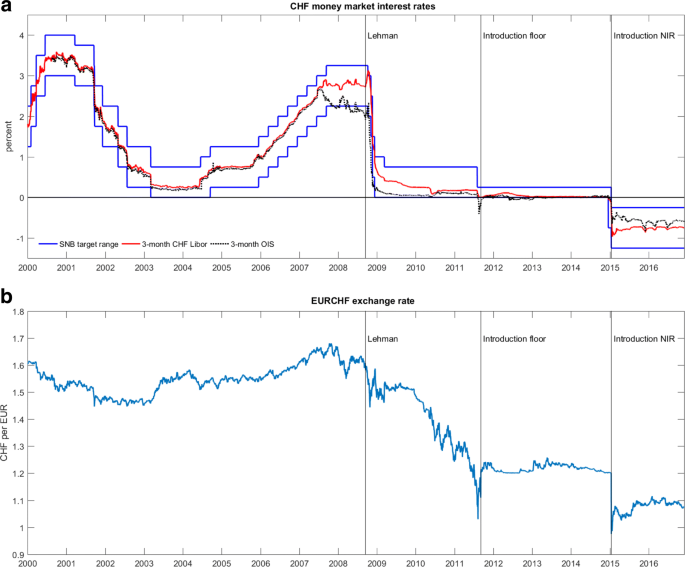

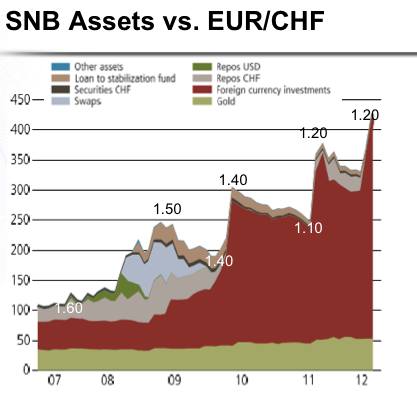

The swiss national bank snb has lifted the minimum exchange rate of chf1 20 per euro introduced in september 2011.

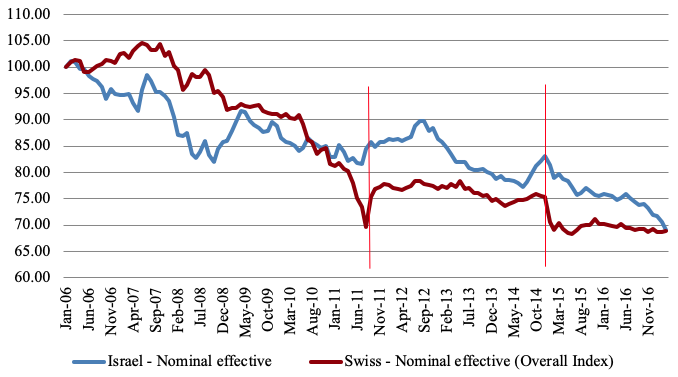

Swiss national bank exchange rate floor. The swiss central bank decided to implement a minimum exchange rate capping the value of the franc at just over 0 83 in order to keep things under control and ensure the country s exporters. The ecb may either ease monetary policy this year or commit to keeping current low rates for longer this would probably see the swiss franc. This morning the swiss national bank snb decided to abandon its minimum exchange rate floor policy. The swiss national bank snb is discontinuing the minimum exchange rate of chf 1 20 per euro.

The benchmark administrator six calculates and publishes saron to six decimal places and is responsible for licensing. For foreign currencies for which the fta does not publish an exchange rate the daily exchange rate sell published by a swiss bank is applicable. The decision caught markets by surprise and caused the swiss stock market to. The exchange rate chosen by the taxpayer has to be kept for at least one tax period and has to be used for the calculation of the domestic tax the reverse charge and the input tax.

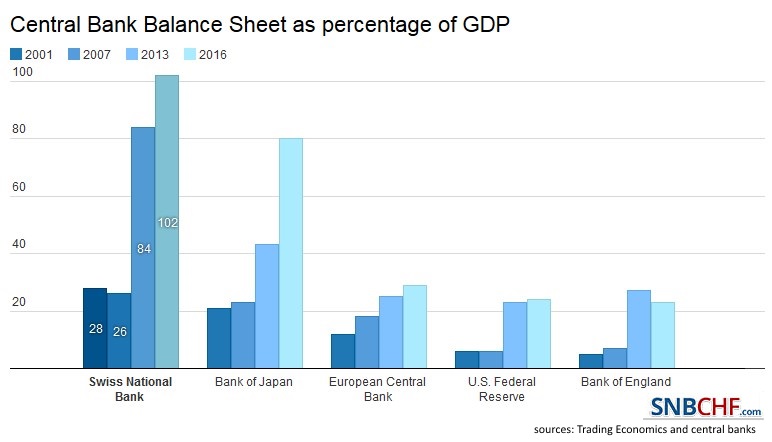

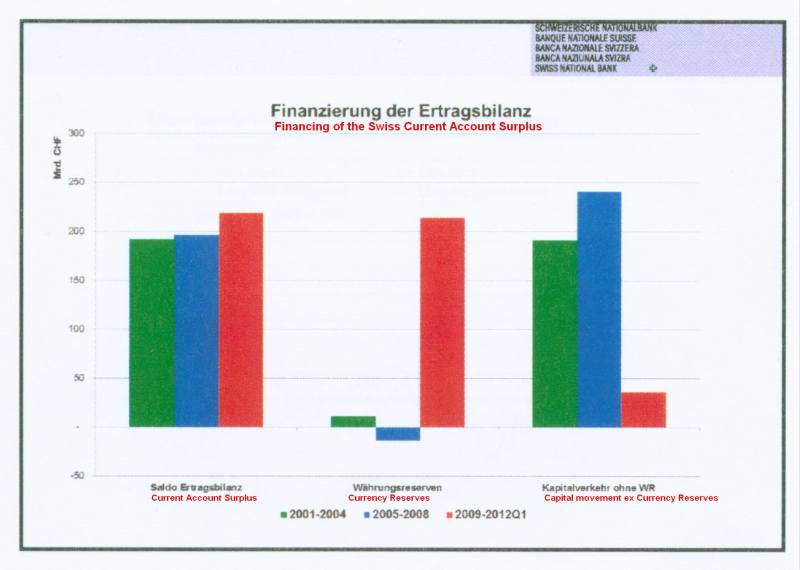

Please note that saron is published on the snb website for illustrative purposes only and is rounded to two decimal places. Since the start of the crisis the snb has tried to limit exchange rate appreciation by spending 633 billion francs on foreign currency assets and. The swiss national bank has felt differently. It is prohibited to use saron as published on this website for commercial purposes.

At the same time it is lowering the interest rate on sight deposit account balances that exceed a given exemption threshold by 0 5 percentage points to 0 75. So on january 15th when the swiss national bank snb suddenly announced that it would no longer hold the swiss franc at a fixed exchange rate with the euro there was panic.

.png)