The Arithmetic Average Rate Of Return Measures The

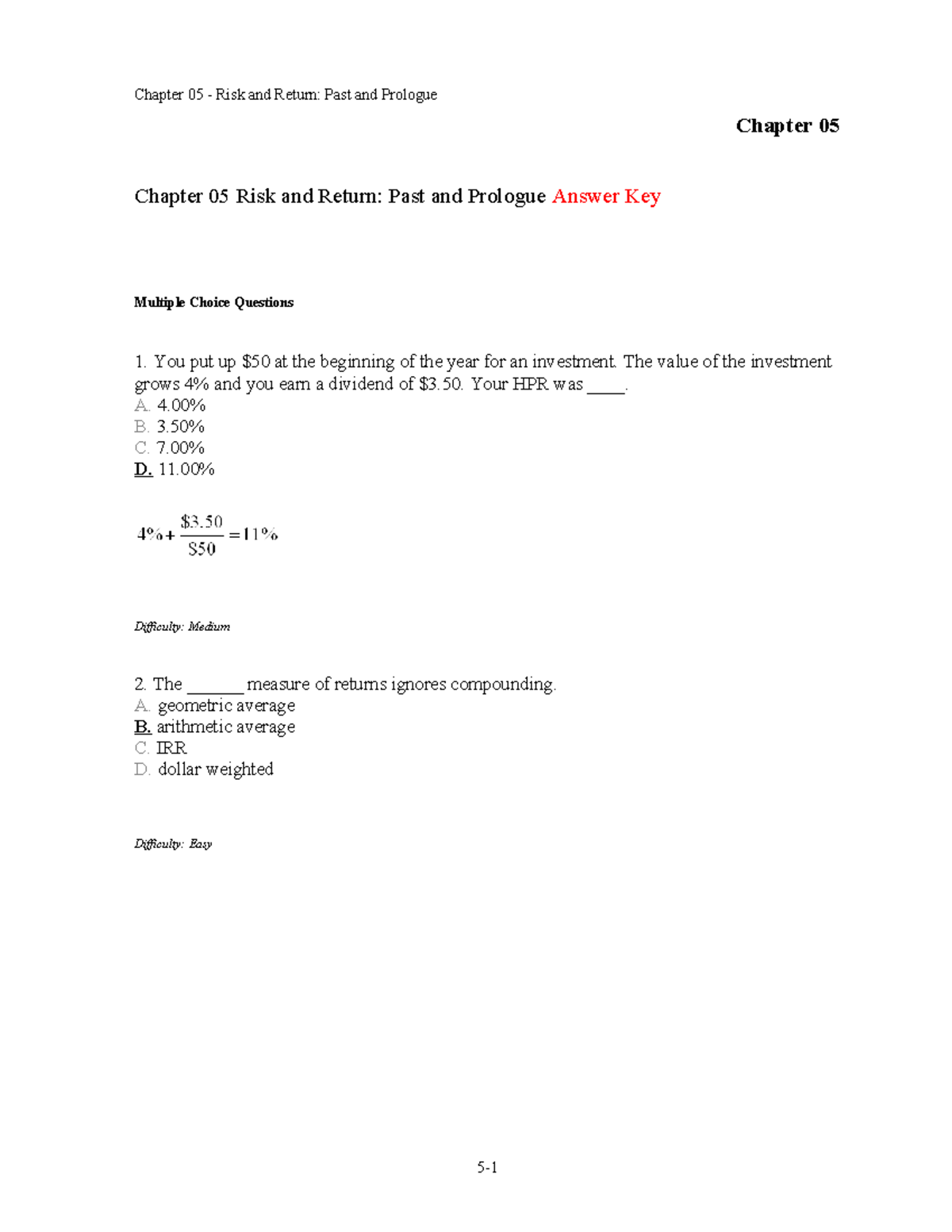

T bills which had the lowest risk generated the lowest return small company stocks generated the highest average return.

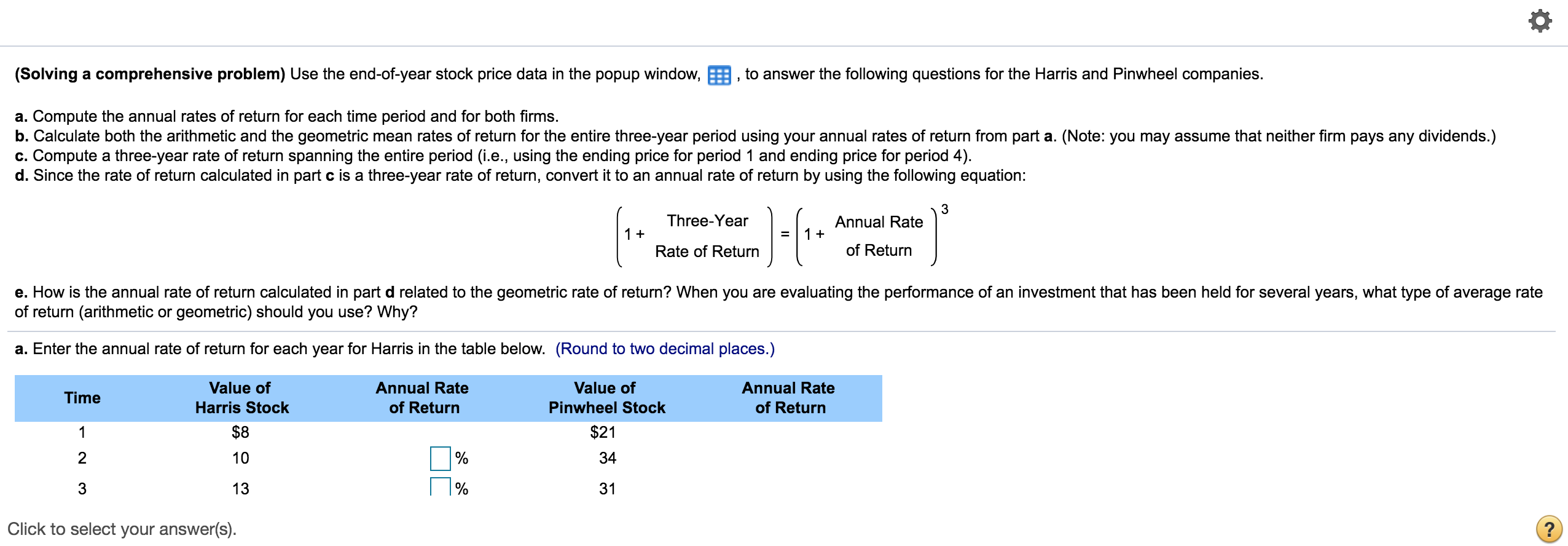

The arithmetic average rate of return measures the. Capital gains or losses. Geometric average return is a better measure of average return than the arithmetic average return because it accounts for the order of return and the. The arithmetic average return is always higher than the other average return measure called the geometric average return. Using the geometric average return formula the rate is actually 5 95 and not 6 as stated by the arithmetic mean return method.

The arithmetic average rate of return measures the. Money weighted or internal rate of return. Geometric average return is the average rate of return on an investment which is held for multiple periods such that any income is compounded. The total return using the more accurate method would be 5 946 66 which is a difference of 8 42.

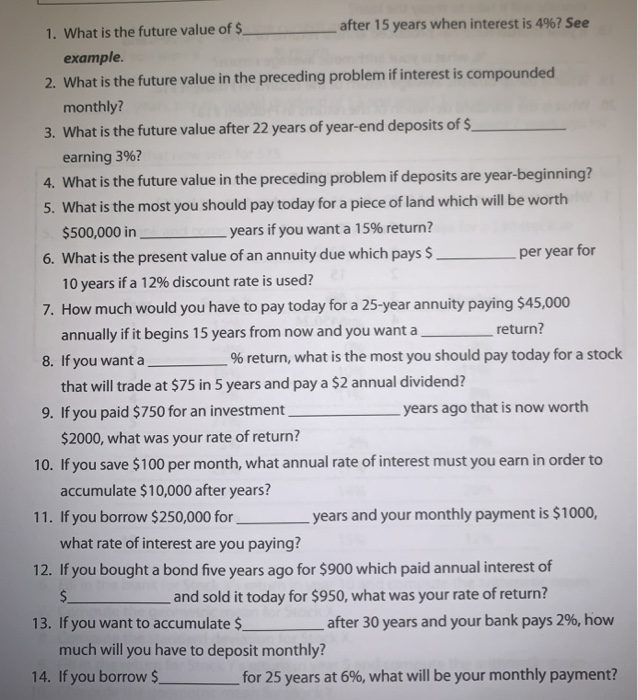

In the example above it will be more suitable to calculate average annual returns than to know the returns earned over 7 years. In other words the geometric average return incorporate the compounding nature of an investment. With the arithmetic average the average return would be 12. The total dollar return is the sum of dividends and.

In microsoft excel you can use the function average. The return in an average year over a given period. A good understanding of the difference between the two methods of calculating returns helps analysts to invest wisely. The ibbotson sinquefield data show that over the long term.

Dividends are the component of the total return from investing in stock. Calculating arithmetic average in excel. Investors usually consider the geometric mean a more accurate measure of financial portfolio performance than the arithmetic mean. While calculating the aggregate returns our return measure will vary depending on what method we use to calculate the aggregate returns.

The arithmetic average rate of return measures. An arithmetic mean is a simple process of finding the average of the holding period returns. Computers calculate arithmetic average for us. Two common methods are arithmetic returns and geometric returns.

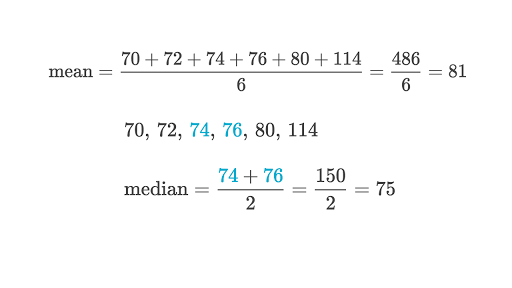

Arithmetic average return is the return on investment calculated by simply adding the returns for all sub periods and then dividing it by total number of periods. The arithmetic return and geometric return are both methods commonly used to calculate the yield on a given investment. For example if a share has returned 15 10 12 and 3 over the last four years then the arithmetic mean is as follows. Though the calculation is very simple it can be boring and prone to errors when you work with large sets of data imagine calculating the average return of the 500 stocks in s p500 like this.

Return in an average year over a given period.