The Arithmetic Average Return Is The

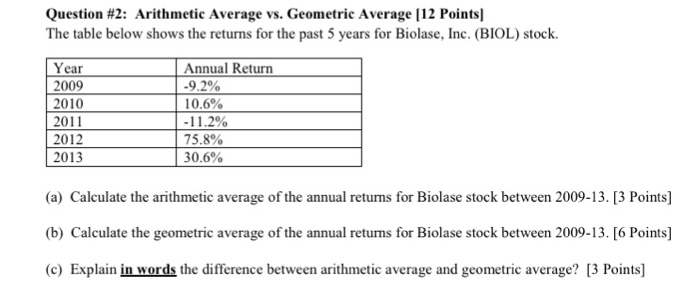

Geometric average return is the average rate of return on an investment which is held for multiple periods such that any income is compounded.

The arithmetic average return is the. What is the arithmetic mean. But is this your real return. The arithmetic average return calculator is used to calculate the arithmetic average return of an investment given the initial value of the investment and the value of the investment at the end of each period. Arithmetic average return is the return on investment calculated by simply adding the returns for all sub periods and then dividing it by total number of periods.

Two common methods are arithmetic returns and geometric returns. That s because when it comes to annual investment. This is the value of the investment on the day you bought it. If you start with 1 000 you will have 2 000 at the end of year 1 which will be reduced to 1 000 by the end of year 2.

With the arithmetic average the average return would be 12 which appears at first glance to be impressive but it s not entirely accurate. The average investor is often misled by the media and institutions which incorrectly use the arithmetic average return. The mean will be displayed if the calculation is successful. Applying the geometric mean return formula outlined above will give you a mean return of zero.

In other words the geometric average return incorporate the compounding nature of an investment. The mean arithmetic average return of our basket of 10 stocks in the last year was 4. One example of average return is the simple arithmetic mean. This information is already quite clear and easy to work with.

10 15 10 0 and 5. To clear the calculator and enter new data press reset. Initial value use this field to enter the initial value of the investment. The arithmetic mean return will be 25 i e 100 50 2.

Geometric average return is a better measure of average return than the arithmetic average return because it accounts for the order of return and the. For example suppose an investment returns the following annually over a period of five full years. Thus you earn a return of zero over the 2 year period. The mean most commonly known as the average of a set of numerical values is a measure of central tendency a value that estimates the center of a set of numbers.

An investment manager or mutual fund will probably quote the 5 0 return. The correct calculation or your actual return would be 1 98. You sum up all the values and then divide the sum by the number of values. In the example above it will be more suitable to calculate average annual returns than to know the returns earned over 7 years.

The arithmetic average return is always higher than the other average return measure called the geometric average return.